It’s probably the most overused quote in tech writing… which

sucks, because I’d really like to use it to describe how I feel about the

Chromecast.

The Chromecast is deceptively simple: you plug it into your TV,

then stream video and music to it from apps running on your iPhone, Android

device, or laptop. The Chromecast itself has no remote; whatever device you’re

streaming from is the remote. The Chromecast has next to no user interface of

its own, either; it’s got a single screen that shows the time and whether or

not it’s connected to your WiFi that appears when nothing is being streamed,

but again, the device you’re streaming from largely acts as the interface. The

Chromecast is a wireless portal to your TV, and doesn’t try to be anything

more.

A Box Full Of Surprises

I’ve been thinking about it all night, and I don’t think I’ve

ever been as surprised by a device as I am by the Chromecast.

The price? Surprise! It’s $35. Are you kidding me? According

to Google, they’re not selling them at a loss. Even after accounting for the

Wi-Fi chip, the CPU, 2GB of flash memory, the RAM, licensing the right to use

HDMI, assembly, packaging, and shipping them to the states, they’re somehow

making money selling these things for thirty

five dollars. Sure, their profit margin is probably like, four

cents — but that they’re not selling these at a loss at that price point is

kind of absurd.

The setup? Surprise! It’s ridiculously easy. Plug it into HDMI,

give it some juice (through USB, which most new TVs have, or a standard

wallwart), then run the Chromecast app on a laptop to tell it what Wi-Fi

network to connect to. Done.

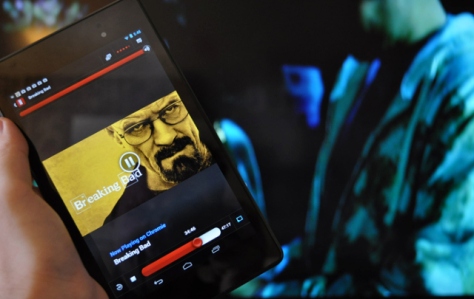

App compatibility? Surprise! It’s already there on day one in

some of the most notable online video apps, including Netflix and YouTube. I

didn’t even have to update the apps — I just launched ‘em on my phone and the

Chromecast button was sitting there waiting for me. They’ve even already built

an extension for Chrome that drastically expands the functionality of the

device (though, in its beta state, it’s a bit buggy — more on that later).

Hell, even the very announcement of the Chromecast was a bit of

a surprise. Google somehow managed to keep the Chromecast a secret until right before its

intended debut, even with a bunch of outside parties involved. Netflix,

Pandora, teams from all over Google, everyone involved in the manufacturing

process — all of them were in the loop, yet nothing leaked until someone

accidentally published a support page a few hours too early.

Now, none of that is to suggest that the Chromecast is perfect.

It’s not! Not yet, at least. But its biggest issues are quite fixable, assuming

that Google doesn’t look at the “overwhelming” sales of the Chromecast

and say ‘Oh, well, screw this thing.’ And for just $35, the few blemishes it has

are pretty easy to overlook.

Taking The Bad With The Good:

Video streaming quality is quite good (on par with what I get on

my Xbox 360 or my Apple TV, at least) particularly when pulling from an app or

website that’s been tailored for compatibility — so Netflix, Youtube, or Google

Play, at the moment.

If you’re using the Chromecast extension for Chrome on your

laptop to project an otherwise incompatible video site (like Hulu or HBOGO),

however, video quality can dump quite a bit depending on your setup. It’s using

your laptop as a middle man to encode the video signal and broadcast it to the

Chromecast, whereas the aforementioned compatible sites just send video

straight to the dongle, mostly removing your laptop from the mix. When casting

video tabs on a 2012 MacBook Air running on an 802.11n network, the framerate

was noticeably lower and there were occasional audio syncing issues.

While we’re on the topic, the Chrome extension packs a bit of an

easter egg: the ability to stream local videos from your laptop to the

Chromecast. Just drag a video into Chrome, and it’ll start playing in a new

tab. Use the Chrome extension to cast that tab, and ta da! You’re streaming

your (totally legitimate, not-at-all-pirated-am-i-right) videos without

bringing any other software into the mix. I tried it with a bunch of video

formats (mostly AVIs and MKVs. MOVs kinda-sorta work, though most won’t push

audio from the laptop to the TV for some reason), and they all seemed to work

quite well, albeit with the lowered framerate I mentioned earlier.

Even within the apps that have already been tweaked for

Chromecast compatibility, there are some day one bugs. Sometimes videos don’t

play the first time you ask them to, instead dropping you into a never-ending

loading screen. Other times, the video’s audio will start playing on top of a

black screen. These bugs aren’t painfully common, but they’re not rare, either.

Fortunately, it’s mostly all good — and it can only get better

Even with a bug or two rearing its head, the Chromecast is easily worth its $35

price tag.

Remember, this thing just

launched, and it came mostly out of nowhere. Those bugs? They’ll get patched

away. The sometimes-iffy framerate on projected tabs? It’ll almost certainly

get better, as the Chromecast extension comes out of beta.

Pitted against the AppleTV — or, in a fairer comparison, against

the AppleTV’s built-in AirPlay streaming feature — the Chromecast’s biggest

strength is in its cross-platform compatibility. Whereas AirPlay is limited to

iOS devices and Macs (with limited support for Windows through iTunes),

Chromecast will play friendly with any iOS, Android, Mac, or Windows app that

integrates Googles Cast SDK. Having just launched, the Cast protocol obviously

isn’t nearly as ubiquitous as AirPlay, either in terms of Apps that support it

or in terms of other devices (like wireless speakers) that utilize it — but

assuming that developers embrace the format (and really, they should), both of

those things could quickly change. If developers support the protocol, Google

could quite feasibly open it up to third parties to be integrated directly into

TVs, speakers, and other types of gadgets. If that happens, AirPlay could be in

trouble.

On the topic of its cross-platform compatibility: the experience

on Android is a slightly better than it is on iOS, as Google has considerably

more freedom on the platform; for example, apps that use Chromecast can take

priority over the lockscreen, allowing the user to play/pause/skip a video

without having to fully unlock their Android device. That’s just icing on the

cake, though; for the most part, all of the primary features work just as well

on iOS as they do on Android.

Conclusion

It’s one of the easiest recommendations I’ve ever made: If the

Chromecast sounds like something you’d want, buy it. It’s easily worth $35 as

it stands, and it’s bound to only get better as time goes on, the bugs get

ironed out, and more apps come to support it.